Out of the various passive income-earning investments, buying stocks are a good way to earn if you’re thinking long-term. It is a gamble because you aren’t sure if the company will profit, but those who are successful know that big rewards require big risks. However, it’s less of a risk if you know how to navigate the different stocks smartly.

For instance, that means buying stocks from well-established companies expected to grow in the next few years. With the rise of technology, online advertising, and with over a billion users, Google (or more specifically, its parent company, Alphabet Inc.) is a smart bet to back in the stock market. However, you may find two stock tickets that are confusing: GOOG and GOOGL.

Both tickets come from Alphabet, both are stocks for Google’s company, and both have roughly the same price. But why is there a need for two tickets in Google? To understand what you might be buying, here’s what you need to know about buying stocks from Google.

How Stocks and Shares Work

Dividend stocks are basically your way of earning a stake at a successful company. When you buy from the stock market, you’re buying a certain share of the company’s profits. When a company does well in a certain amount of time, a part of that is paid back to investors based on the amount of shares they have already bought. This dividend can be received as a cash payment or can be used by the investor to buy more shares to increase their percentage of the profits.

As much as possible, some investors never put all their eggs in one basket and diversify their portfolios. If you have $10,000 to invest in stocks, some investors would recommend putting it all on a company that is sure to grow in the next decade or so, but this is a high risk if your hunch is wrong and the company fails. This is why plenty of successful investors recommend diversifying your portfolios and buying stocks from multiple companies. Personally, I think it’s a much better decision to diversify because it’s a good way to dip your toes into the stock market’s waters because if one company fails, you lose your investment in that company but you have other stocks whose profits could break your fall.

Because dividends are based on the company’s profits, it’s not like earning a salary where your income is fixed. If the company you have stocks in has a good year, you could earn more than your expected dividend; on the other hand, a bad year means a smaller dividend, which could lead investors to pull out their investment before they lose their entire investment.

Choosing Where to Invest

There’s really only two ways to go about choosing: go with your gut, or base your decision on the available data about the company’s profits. The smart decision would of course be to look at the company’s data and see if there is a growth or decrease in profits in the last few years.

For new companies entering the stock market, this may be difficult to determine. This does not mean small, new companies are a bad investment, though. In the best case scenario, an investor who puts their faith in a small company may soon find themselves backing a trailblazer that booms in the next few years. At worst, they simply put their money on the wrong horse and lost.

Back in 2014, the cost of Facebook’s common stock was $73.63. Four years later in 2018 it was $209.94. As of writing this article in 2019, it’s $187.85. People who bought stock in 2014 would definitely benefit from their investment today, but those who bought stocks in 2018 would be disappointed in the results and would consider either cutting their losses now or waiting for Facebook’s stock to get better. The stock market is always fluctuating, so as long as you’re willing to take the risk, it’s best to base your investments on smart financial decisions.

Google & Alphabet Inc.: Background

GOOG and GOOGL were both stock ticker symbols for Google until 2015, when it reorganized its interests and became a subsidiary of the conglomerate Alphabet Inc. The difference between the two is that GOOGL is the ticker for Class-A shares while GOOG is for Class-C shares.

In 2014, Google’s co-founders and chairman did a stock split, which divides its existing shares into even more shares to boost its liquidity. Splitting stocks does not change the dollar value of the share, so to make it fair for existing shareholders, a company will provide more shares based on a ratio to those who already own shares. This was an attempt on Google’s heads to retain as much control of the company as possible, as it’s possible for founders to lose control of their company when they go public and have too many people owning shares.

These shares were divided into three: Class-A GOOGL stocks, Class-C GOOG stocks, and Class-B stocks. Unlike Classes A and C, Class-B shares are owned by insiders (senior officers and high-ranking members of the company and anyone else who own have more than 10% of the company’s voting shares) and are not available for purchase outside of Google. In Google’s case, Class-B stocks belonged to co-founders Sergey Brin and Larry Page, Chairman Eric Schmidt, and a few other directors. In 2015, Google was re-organized and became the main subsidiary of Alphabet, though the tickers remained GOOGL and GOOG.

GOOGL vs. GOOG

While GOOGL and GOOG are stocks under the same company and roughly have the same price in the stock market, their one defining difference is the stockholders’ ability to vote in major decisions. Remember how I said stockholders invest and get a share at the company’s profits? Some big-time investors might sometimes put a lot of money into a certain company. Because investors don’t want to lose their investment because of missteps or bad financial planning due to the company’s officers, some stockholders buy stocks that come with the condition that they have a say in the company’s major decisions.

Not all stockholders have the same amount of votes, though, and some stockholders may receive dividends but have no voting power. Let’s say Company X has 100 stocks: 51 belong to the CEO, 25 belong to A, 20 belong to B, and 4 belong to C. In this case, assuming one stock equals one vote, the CEO has the controlling stocks because they own more than the others combined and would always have the last word. But if investor A had premium stocks that were worth 2 votes per stock, the voting would turn out differently: that meant the CEO would have to get investors B and C on their side if they didn’t want Investor A to win the voting. This simplifies the concept a bit, but it’s similar to the way Google’s stocks work.

Difference Between GOOG and GOOGL

GOOGL is the ticker for Class-A common shares. These come with voting rights and an ownership stake. These are often held by regular investors in the stock market. GOOG, on the other hand, is also a common share for Class-C shares that provide ownership stake, but not voting rights. These are held by both regular investors and employees of the company.

When Alphabet reaches a point where it has a major decision to make that can affect the company’s profit, Class-A shareholders have a right to vote on which direction Alphabet will take. Class-C shareholders will not have a right to vote even if the decision could affect their dividends.

Class-B shareholders, however, have the upper hand with 10 votes per share. This gives the Alphabet co-founders and senior officers with more voting power compared to the rest of the shareholders. As of 2019, there are around 298.3 million Class-A shares and 47 million Class-B shares. This means B holders have 470 million votes or 61% of the votes.

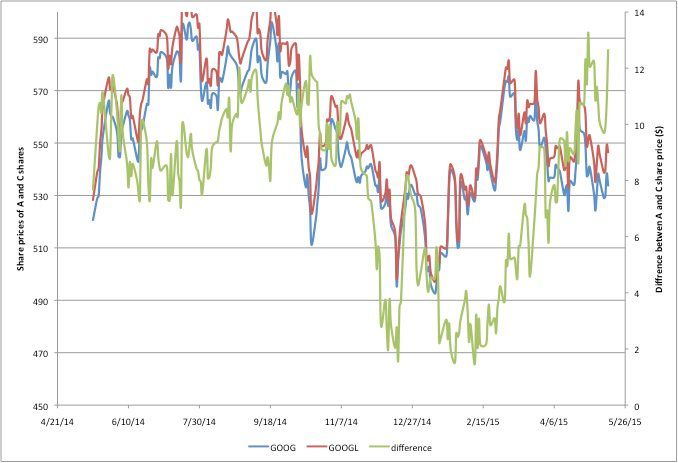

In terms of price, GOOGL shares are almost always slightly more expensive than GOOG shares. On August 1, 2019, GOOGL shares were worth $1,211.78 while GOOG shares were at $1,209.01. The price difference is very minimal, but it varies because GOOGL has voting rights while GOOG does not.

The difference in price has never gone up more than 2%. Due to some shareholders objecting the stock split when it happened, Alphabet promised to compensate Class-C shareholders if the value of their stock ever fell less than 1% than Class-A stocks. However, the prices have always been almost similar, though more often Class-A shares have always been more expensive than Class-C shares.

Should I Buy GOOG or GOOGL Stocks?

Assuming you’re not a high-ranking Alphabet officer, your only available options come down to GOOG and GOOGL stocks. While the price difference is very small, your decision to buy Class-A or Class-C stocks can affect your portfolio greatly.

If you want to have voting rights and have your say when Alphabet makes major decisions, then the additional money spent on Class-A shares is worth the additional cost. However, if you’re interested in getting more shares for your money and aren’t really interested in voting (some investors prefer to let the higher-ups and senior members with experience handle all the major decisions instead), you should opt for Alphabet’s Class-C shares.

However, take note that the current price of both Alphabet Inc. shares are over a thousand dollars. In comparison, Apple’s share value as of writing is $202.75, Microsoft is at $133.98, and Facebook is at $179.71.

Sure, it’s a lot less than Amazon’s stock price at the moment ($1,762.96), but take note that it’s a relatively high amount compared to other stocks. If Alphabet only continues to grow exponentially in the next few years, the thousands you spend on shares now can be worth much more in the future. But if it’s actually reached its peak and can only go down from here, you’ll be lucky if you can breakeven. As much as possible, buy low, sell high, and diversify your investments in different companies.