In business, failing to plan means you are planning to fail. This also applies to small to medium enterprises despite their size and capital limiting their operations compared to bigger enterprises such as companies and corporations.

Nearly anyone can start a business, even if you don’t have the proper training of a business graduate from colleges and business schools. However, a lot of the things that business graduates are taught, including business strategies, are necessary for all business owners. You don’t need to write a thesis or learn the history of commerce, but you do need to know how most businesses function if you have dreams of seeing your business grow.

With that, here are business strategies you, as a small business owner, ought to know and how you can apply each strategy to look at your business’ potential.

Strategy #1: The 3-Part Strategy

The advantage of a small business that bigger businesses don’t have is the flexibility of their operations. While bigger brands we see in almost every store have reached a level where they can’t reach each customer personally (you’ll never see Warren Buffett handing out Coca-Colas in any Walmart), smaller businesses have the ability to get personal with their customers since they have a much smaller pool of target customers.

Which is why, when it comes down to it, small businesses have three factors they can use to their advantage: their employees, their marketing, and their customers.

Employees

Small businesses are at a disadvantage because it’s highly unlikely they have the funds to hire the best in their industry. A small restaurant in a suburban area, for example, can’t afford to hire a Michelin Star chef to make pasta and wings, but popular five-star restaurants along the Vegas strip can. While plenty of small businesses are run by family, sometimes it is necessary to look for people outside the family. But with a relatively small salary budget and a smaller pool of people who are competent and have the needed skills, how do you choose the right employees?

For starters, you need employees who have a passion or at least an interest in the industry your business is in. In this economy, you can always find someone willing to do the job, but what they provide you is the bare minimum, with some even too lazy and think they deserve a pat on their back just for doing what was written in their job description. Skills be taught, but passion and interest is a trait worth paying for.

No matter how smart an employee is or how impressive their experience is, if they don’t share the same values, mission, or attitude you want your business to have, it’s best to find someone else in your business. Remember, you’ll be working with your employees to implement whatever strategy you choose, and you need everyone to be on the same boat if you want to make your business run smoothly.

Marketing

Unlike bigger companies that have teams of marketing and advertising moguls who have a good idea on how to make something viral across the country, you don’t need that and have an advantage on a personal level. That doesn’t mean, however, that you should look at marketing as something low cost (or even free) and you can simply get your business to grow through word of mouth. While that is one effective way of online marketing, no business can survive on the referrals of happy customers.

If your business’ budget seems tight, don’t think that you can completely cut your marketing budget. Without marketing, you can’t expect to get more customers through your door, thus dropping in sales, revenue, until you risk losing your business to bankruptcy.

Customers

While you should be ready to welcome new customers, small businesses should focus on keeping loyal and existing customers happy and build on the relationships established. Unlike businesses that have an impersonal level on customers, small businesses have the luxury of being a staple and developing a personal relationship with people in the area.

For instance, take this experience my sister had with this one restaurant. This restaurant was very out of the way – around a one-hour drive from where we live – but it was a small restaurant with glowing reviews, so my sister and her partner thought it was worth the drive there. By the time they got there though, it was five minutes after closing time. They explained that they had come all this way to try their food and asked the owner if they could at least order a takeout. The owner assured them they were welcome to stay and allowed them to dine in. Thanks to the owner and staff’s hospitality and their delicious food, that restaurant is now one of our go-to places to celebrate, spending almost a hundred dollars each time we visit.

If you provide customers service that will make them want to come back, they will. Even if you charge more than your nearby competitors, if they find that their experience with your business is a positive one, they won’t go out of their way to find other services unless they really have to cut costs. But, you will find that keeping existing customers is a lot cheaper than finding new customers. If you operate in a certain community and perform so poorly that you have a negative reputation and all the locals start to avoid your business, you’ll have to expand your market outside the business, which means a higher marketing budget.

While I did say earlier that word-of-mouth marketing was not the only thing small businesses can rely on, it is a small business’ advantage over bigger companies and can provide new business opportunities. When your customers spread the word and recommend your business to people they know or on online websites like Yelp and TripAdvisor, you’re getting free publicity without having to pay them compared to, say, larger companies and well-funded start-ups that can have to pay influencers up to a million dollars just to talk about the product.

In this strategy, though, customers can be a double-edged sword. Make customers happy and they’ll spread the good word about you and convince potential new customers to visit; provide poor service, and they may dissuade potential customers from even giving you a chance.

Overall, while this is a good strategy, it’s not one you should use if you’re looking long-term and are planning to grow your business or have it franchised. Therefore, with small business grants have to deal with legal and government-related matters when it comes to running a business such as paying the appropriate taxes and dues and adhering to certain standards (such as sanitation standards for food businesses).

But if you’re looking at it operations-wise, cooking a burger in a McDonald’s chain where cooking times are measured down to the second is a different matter from cooking a burger in a mom and pop restaurant. This can be used to your advantage, especially if this is a business you enjoy doing for a small community where almost everyone knows you personally, but if you’re looking in the long run, passion and drive may get you a stable business, but it won’t rake in the money. Some businesses are fine with staying small and operating without the business jargon used in bigger businesses, but if you’re thinking about your business from a financial perspective, you will have to learn about the other tried and tested business strategies.

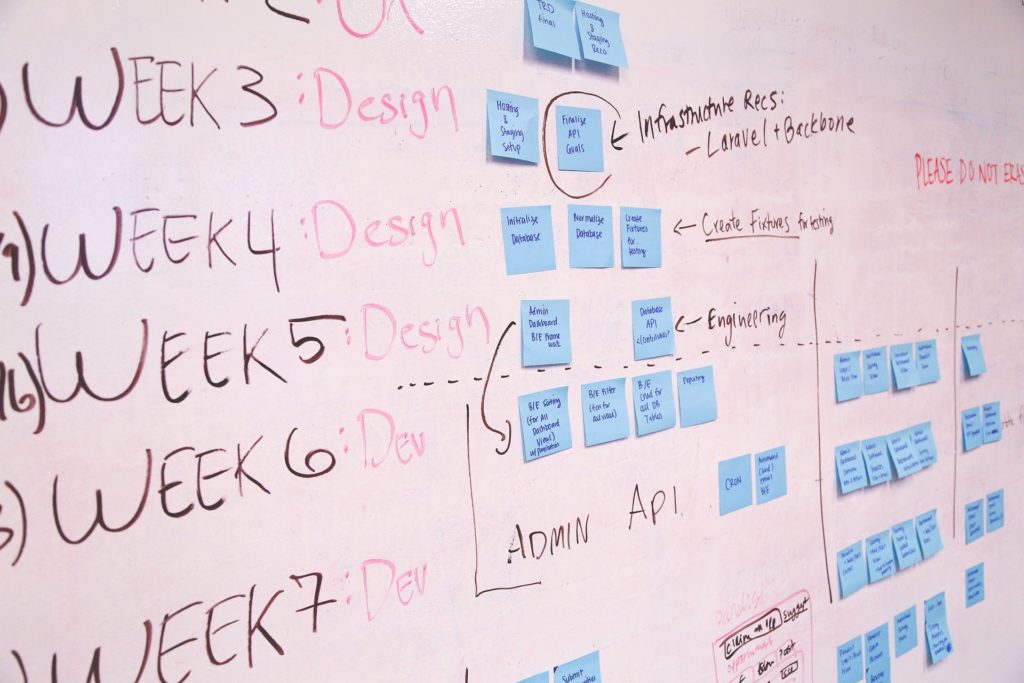

Strategy #2: Using the Industry Life Cycle and Acting Accordingly

My first marketing professor taught me that no matter how trendy and successful a product or service is, if it does not innovate, it will die out eventually. For example, back in 2014, “loom bands” – colorful rubber bands twisted into bracelets, keychains, and other accessories – became a hit all over the world. I saw people starting online businesses selling those rainbow loom kits and wholesale rubber bands – and we’re talking about sacks of mini rubber bands sold in kilos. I even saw people trying to sell their creations for almost twice the cost of the materials used to make them. But then the trend died, and everyone who bought into the trend with the intention of selling for the long run were stuck with rubber bands that no one really wanted.

Loom bands aren’t the exception to this rule. Take a look at fidget spinners, shutter shades, hoverboards, and salted egg chips: all these were popular products in their time, but when the trend dies and no one is clamoring to buy them, you’re just left with products that may be difficult to sell without the trend. As of writing, boba tea is a popular trend leading to people opening their own small boba tea stores to compete with the bigger names; what happens to them when juice or iced tea becomes the next big trend?

Thus, it is important for even small business owners to understand their industry life cycle, even though it has a different meaning in the context of bigger businesses. If you’re selling a product that’s currently trending, how long do you have to capitalize on the trend before it becomes unlikely to sell?

What Is the Industry Life Cycle?

This concept believes that all operating businesses will see progress, growth, and then a slump. During this slump, either the business can innovate or change the way they operate to start the cycle all over again, or they can simply cut their losses and give up. If you’re looking at the long-run, surely you’ll choose the former option. But some small business owners may see their business as not worth keeping in the long run and opt for the latter.

An industry life cycle typically has five stages: startup, growth, shakeout, maturity and decline. There’s no telling how long one cycle lasts in a business, though it usually spans out months and can even reach years before a business starts to see the first signs of decline.

Startup Stage

At the startup stage, you won’t have a lot of customers because not that many people recognize your business and what you have to offer compared to your competition. Let’s say, for example, that your small business is a local convenience store in your community. Compared to a 7-Eleven or Sheetz, your convenience store is relatively unknown. Why would people want to visit your unknown store of unknown quality when there’s a 7-Eleven nearby? To answer that, you have to bank on your marketing strategy and promotions in order to get word out that people should visit your store.

At the beginning of your business, you may not have a lot of sales, which translates to possibly generating no or low profits, sometimes even experiencing negative cash flow at the beginning since it is very unlikely that you can offset the cost of starting your business during your initial launch.

So, let’s say you have your convenience store. According to The Really Useful Information Company, it can cost around $50,000 to open a convenience store. While convenience stores can earn up to the millions range in a year, average small businesses like a one-branch convenience store can earn as low as $30,000 a year.

Your business is at a disadvantage because you’re less known that your bigger competitors. However, since you have the advantage of flexibility, you could use that to your advantage. People may be more likely to go to your shop rather than your competitors if you have advantages like location, price, and quality. How you attract them in this stage may cost you, but if it means getting loyal customers in the long run, it’s worth it.

Growth Stage

As your business slowly attracts more customers, your profits will begin to grow. You may find more people stepping into your shop and increasing customer demand. This results in more cash flow, more profit, and costs breaking even or going less than the cost. There will be fixed and variable costs to running the business (in the case of a convenience store, it’s the salary of your employees, utilities, suppliers, etc.), but during your growth stage, all of these will be offset by the money you’re making.

Shakeout & Maturity Stage

During these two stages, your business survives its competition and continue to grow by adapting and strategizing their sales. Despite being a small business, you have managed to earn enough sales to establish your store and decrease your chances of going out of business as it has matured into an established business capable of staying afloat due to your steady stream of customers.

However, this does not mean you can be complacent. The shakeout and growth stages are different because, while the profit you earn from the growth stage is significantly bigger than from when you started your business, the cash flow is slower once your business matures.

During the majority stage, you have to look at this cycle both in your own business as well as your industry. Over time, you may find that you as a business are struggling to find new ways to innovate to attract more customers. At the same time, you might find that your business is surrounded by a lot of competition. Prior to the boba tea craze, you could only find a handful of successful businesses selling; after more and more people were buying boba tea, small businesses have opened to get a piece of the profits. Existing boba businesses are now saturated and have to find new ways to compete with similar businesses while trying to prevent more businesses from entering the market.

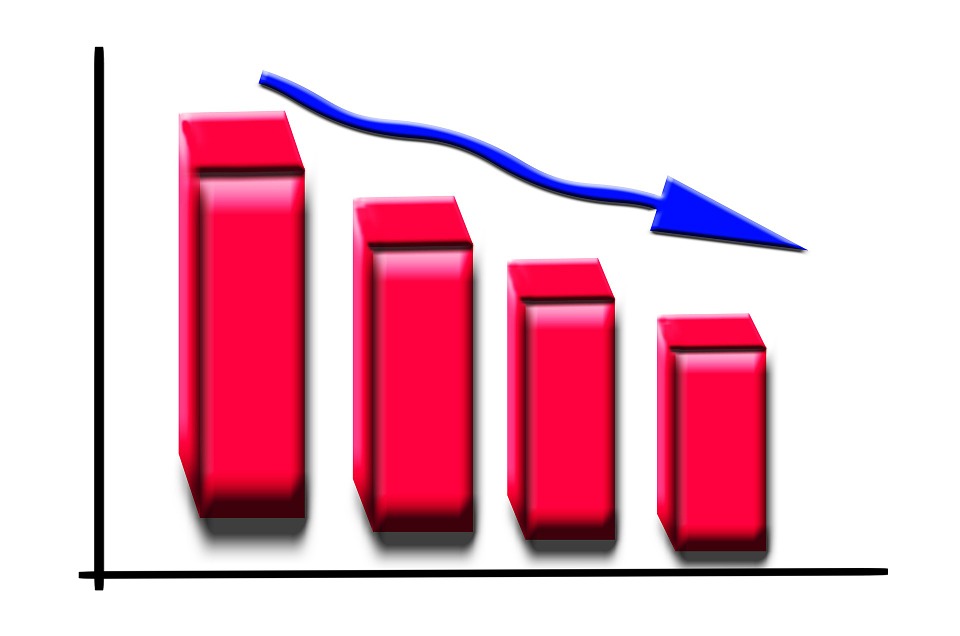

Decline Stage

Once trends and success have come and go, a lot of businesses often fall into decline because they’ve failed to adapt to the new setting. Since we’re using a small business convenience store as our example, allow me to share with you a case study I once read and discussed in one of my marketing classes.

There was a certain convenience store chain in Asia that was a little more upscale than your average 7-Eleven. It was known for its delicious soft serve where a customer could pay less than a dollar for a cone and get as much ice cream as they want as long as the customer could balance it on the cone. While their ice cream is what made it famous, however, not many people were interested in buying their other commodities because they could get most of their products cheaper at a competing convenience store that was practically around every corner in urban locations. After the trend died and no one really cared for the ice cream, no one was interested in the store’s other commodities because it was just too expensive when there was a much cheaper alternative nearby. Because of this, after the trend died, a lot of stores of that brand had to close down.

If you’ve based the success of your business on a trend that isn’t going to last forever, the decline of your business is sure to come much sooner than later. During this decline, you may have the option of trying to innovate, which may not always work out and could result in a loss while trying to revive your business. The other option, however, is to cut your losses and begin closing down your business and trying to make the most out of what you have.

Knowing where your business stands in this cycle can help you understand your business’ position and where to go from there. Are you currently in the growth stage where you have plenty of opportunity and cash flow, or do you find your growth stagnating and have to act on it to avoid hitting your business’ decline?

Strategy #3: Understanding Your SWOT

You might have heard of SWOT outside of business and more on counseling and self-improvement sessions. This is because the SWOT analysis can apply to many things, and using it on your business can help you understand the opportunities you might want to bank on or the threats and weaknesses that your business is vulnerable to.

What is the SWOT Analysis?

A SWOT analysis looks at the internal and external strategic planning process. The good thing about a SWOT analysis over all the other strategies is that it’s flexible enough to apply to your business, your product, your employees, or anything you want to improve in your business. Knowing your SWOT in any of these business factors can help you with your planning and decision making as it provides you with the opportunities you can use or shortcomings you can fix.

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. Your business’ strengths are its key points that gives you an advantage over its competitors. If you can provide the same quality service that your competitor provides but at a lower cost, for example, that’s a strength your customers are looking for, making them more likely to pick your services over your competitors – assuming that that is the only key point they’re looking for.

Your weaknesses, on the other hand, are characteristics that put you at a disadvantage compared to your competitors. If your competitor’s service, for example, offers faster service than you do, your weakness is slow service, which can put off several customers who need services done immediately.

Opportunities are external advantages that aren’t your business’ strengths yet, but if you take advantage of the opportunity, you can turn this into your strength for your business’ growth. For example, your business is located in a community where all homeowners can benefit from your service. Unfortunately, while you provide better quality service at a lower price compared to your nearby competitors, you are too out of the way that not everyone thinks making the trip to your business is worth it. Your location is a disadvantage, but you have the opportunity to one-up your competitors by offering home service, deliveries, or pick up and drop off schemes. The opportunity is there, just like a lot of opportunities, but only really good business owners can spot an opportunity when it presents itself.

On the other hand, threats are external factors that could negatively affect your business and profit. The opportunities you don’t take, for example, can be opportunities for your competitors. Let’s say that you don’t take up the free delivery, home service, or pick up service, but your competitor does. They threaten your business because their convenient service can attract more customers.

By exploring your business’ SWOT, you can find the internal and external advantages and disadvantages you can use to improve your business. Your strengths and weaknesses force you to look inside your business and assess what weakens or strengthens your operations while your opportunities and threats look at external possibilities.

These three strategies may be used in a corporate setting, but they’re just as important to small business owners who want to look at their business in the long run. While it is nice to have passion in your business, looking at your business’ position in an average business cycle and seeing your business’ strengths and weaknesses can help you look at your business in a certain way and improve your operations and the way your business handles its customers to give you a bigger edge against your competitors.